Singapore is a small country known for its Marina Bay Sands Hotel, Sentosa Island, and the Changi Airport, the world’s best airport for seven consecutive years. However, Singapore makes up for its small size by reaching the status of a first-world country. In 2019, Singapore was the fourth among the top financial centres of the world.

Small and medium-sized enterprises (SMEs) are the key drivers of Singapore businesses, contributing around 49 percent to the economy in 2017. The government encourages SMEs to take advantage of digital technology.

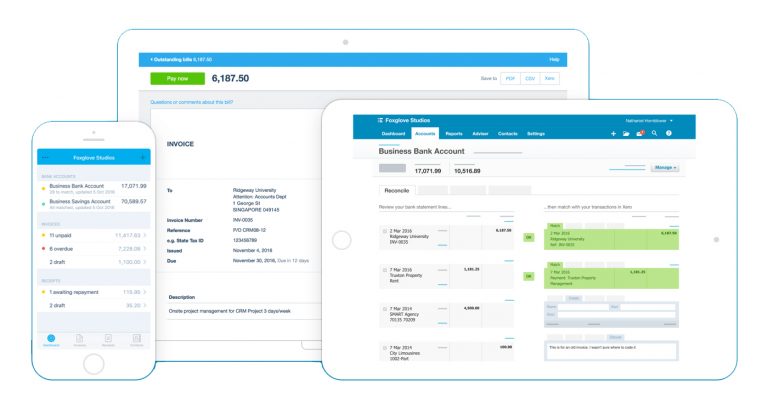

One such advancement is the use of software packages like Xero accounting Singapore. As a cloud-based accounting software, Xero offers many advantages, particularly for SMEs.

Read this article to discover three significant reasons why you should seriously consider getting Xero.

Contents

The government subsidises Xero subscription

To begin with, the customers of Xero accounting in Singapore are eligible for up to 70% government subsidy under the Productivity Solutions Grant (PSG).

The Xero package includes the following:

- One year subscription with price plans ranging from starter (20 USD), standard (30 USD), and premium (40 USD).

- Migration of data if you’re currently using spreadsheets or an old accounting software

- Chart-of-accounts setup

- One-on-one onsite training

- 12 months of technical support from their Singapore-based Xero team

Availing of the package is value for money. One year is more than enough time for your business to test the features of Xero.

Xero is linked with your bank accounts

Xero is integrated with most of Singapore’s banks like DBS, HSBC, OCBC, and UOB.

Therefore, with Xero accounting, you can import your bank and credit card transactions daily. This linkage translates to considerable savings in terms of time and effort. No longer will you have to manually input the bank transactions, a tedious and error-prone process.

Instead, the bank will send you a secure file containing your transaction details. Aside from being assured of data integrity and completeness, your reconciliation process will become less cumbersome.

Xero is available for your mobile devices.

Singapore is one of the few countries in Asia wherein the internet is readily available. In 2019, Singapore reached an internet penetration of 82 percent.

With Xero available on mobile phones, you have the freedom to manage your business remotely. Moreover, since Xero does not set limits on its number of users, you can delegate some of your functions to trustworthy staff when you are on holiday or attending to emergencies.

Xero is compliant with IRAS

The integrated tax requirements of the Inland Revenue Authority of Singapore (IRAS)is one of the most significant advantages of Xero accounting in Singapore.

With the help of Xero, you can submit your GST F5 return and IRAS audit file (IAF)with just a few clicks.

Additionally, Xero automatically converts foreign currency transactions to Singapore dollars (SGD). Therefore, there is no need to convert amounts to their SGD equivalent before creating your financial statements and GS5 F5.

Furthermore, Xero automatically calculates goods and services tax (GST). There has been a steady but gradual rise in the GST rates of Singapore. With the help of Xero, you don’t need to keep track of GST changes is your financial entries.

Conclusion

Xero accounting is one of the best accounting software in the market. By utilising the best in digital technology, you get better control of your cash flow.